Tyler Cowen recently linked to a John Cochrane post, discussing Larry Kotlikoff’s views on public debt sustainability. Here’s Cochrane:

(By the way, if you’re feeling superior and taking comfort that Europe will go first off the cliff, Kotlikoff disagrees. Europe’s debts are larger, but their social programs are better funded, so their fiscal gaps are much lower than ours. The winner, it turns out, is Italy with a negative fiscal gap. Answering the obvious question, Kotlikoff offers

“What explains Italy’s negative fiscal gap? The answer is tight projected control of government- paid health expenditures plus two major pension reforms that have reduced future pension benefits by close to 40 percent.”Don’t get sick or old in Italy, but perhaps buying their bonds is not such a bad idea.)

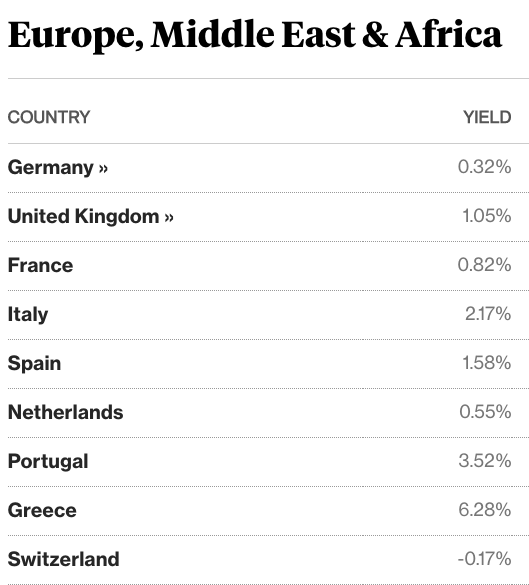

I am a bit skeptical of that claim; so I decided to check with God, er . . . I mean I decided to check with the ultimate arbiter of truth, the asset markets:

As you can see, Italian 10-year bonds offer considerably higher yields than German, French and Dutch bonds, and even higher yields than Spanish bonds. Italy has a massive public debt (third largest in the world), an economy that has shown almost no growth since 2000, and a very dysfunctional political system (which the voters recently decided not to reform.)

As you can see, Italian 10-year bonds offer considerably higher yields than German, French and Dutch bonds, and even higher yields than Spanish bonds. Italy has a massive public debt (third largest in the world), an economy that has shown almost no growth since 2000, and a very dysfunctional political system (which the voters recently decided not to reform.)

I greatly respect Kotlikoff, and even more so John Cochrane. But I respect the markets far more than any mere mortal. So unlike Kotlikoff and Cochrane, I remain relatively pessimistic about the Italian debt situation.

PS. I am back from 5 days in Turks and Caicos (is there a law in the Caribbean mandating nothing but Bob Marley music at resorts?), and I am starting to get caught up.

I have a new post on Bretton Woods as an example of the guardrails approach to policy, and another post commenting on the French elections.

My guardrails post is intended to address tiresome criticism of NGDP targeting by people who have never bothered to actually read what I have written on the topic. No, neither the current lack of interest in NGDP futures trading nor the risk of market manipulation pose any kind of problem for the system I am actually advocating. (Unless you believe, “Bretton Woods could not possibly have worked because speculators would have manipulated the market.”)